Orion180 was an official supporter of the 25th annual International Fraud Awareness Week, which was Nov. 16 to 22. Our Special Investigations Unit lead an engaging education campaign for the entire organization, in addition to ongoing anti-fraud training. Through these efforts, we protect policyholders, optimize operations, and ensure continued growth for Orion180. Read on to discover our Fraud Awareness Insights, and see how fighting fraud helps protect your clients.

Fraud is wrongful or criminal deception intended to result in financial or personal gain. Anti-fraud initiatives are strategies designed to prevent, detect, and respond to fraud. These efforts are critical to protecting all of our Orion180 stakeholders, including agents and insureds. By fighting back against fraud, we protect our financial health, preserve Orion180’s reputation, maintain compliance with regulations, and improve operational efficiency.

At Orion180, our anti-fraud efforts are led by the Special Investigations Unit (SIU), but everyone, including our partner agents, can help support their work with greater awareness.

One measure our SIU uses to detect possible fraud is looking for Red Flags, or Key Fraud Indicators. These are not proof of fraud, but they are early warning indicators. When our SIU sees the red flags, it warrants further investigation to validate the loss.

Some key Red Flags are:

- A loss within 30 days of policy purchase The policy may have been purchased to cover a loss that already occurred, or in preparation for a premeditated event.

- Unusual time lines Raises concerns of premeditation.

- Recent policy changes Adjustments like adding coverage or lowering a deductible may be a sign that the loss occurred before the date reported.

- Delayed reporting of claim Could indicate an attempt to alter or fabricate evidence or facts of loss.

- Unusual circumstances Warning sign of premeditated actions.

While most policyholders are honest, insurance fraud does occur – and it can raise the premiums for all of our insureds. Fraud can occur at the time of the insurance policy application and at the time of a claim transaction.

Once fraud is suspected, the SIU investigation starts. Our team might take steps like industry database research, (OSINT) Open Source Intelligence Investigations, policy and claim documents review, interviews of relevant parties, scene investigations, utilization of experts (engineers and origin and cause experts), medical notes and billing review, examinations under oath, and more.

The SIU team has a complex role in fighting fraud. Your job is simple. If you suspect fraud, you can learn more about reporting here.

Every year, fraud causes billions of dollars in damage to companies, governments, and individuals. Fraud can dramatically affect the quality of life of targeted organizations — and their stakeholders — resulting the loss of savings and investments, weakened trust in institutions, and a significant strain on resources.

In the Association of Certified Fraud Examiner’s (ACFE) Report to the Nations, anti-fraud professionals estimate that the typical organization loses 5% of its revenue annually to fraud (Source: Association of Certified Fraud Examiners).

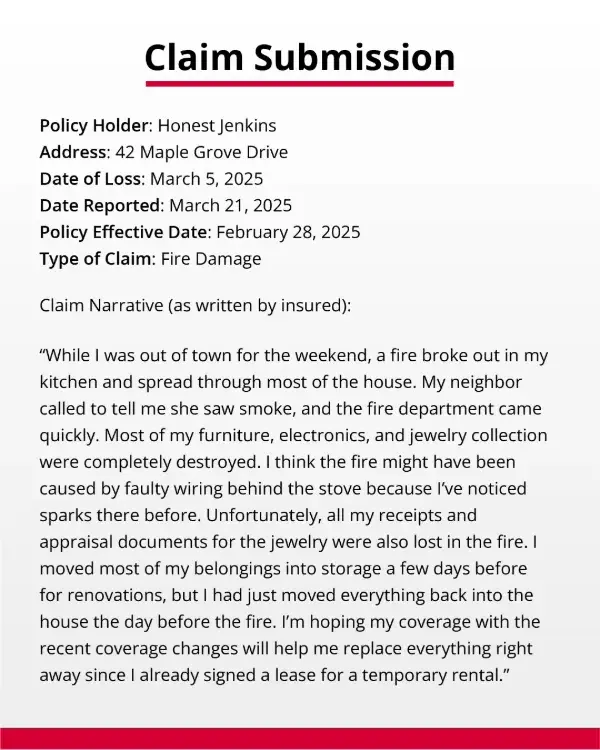

Thank you for increasing your Fraud Awareness! Your new knowledge and vigilance is a vital part of our efforts to fight fraud — put it to the test with our interactive game below. Read the Claim Submission, and see how many Red Flags you can spot.

How many did you spot?

There were six Key Fraud Indicators in our sample claim submission:

- Date of loss is 5 days after policy purchase.

- Claim reported 16 days after the noted date of loss.

- Insured was out of town at the time of loss.

- Insured moved most of their belongings out of the home a few days before the fire and moved everything back the day before the fire.

- Recent coverage change.

- Insured signed a temporary rental lease prior to reporting the claim.