Across the US, stories of unexpected flooding have become all too common. A similar line can be found in many of these articles: “They said they did not have flood insurance because they do not live in a flood zone.”

For those trying to understand who should have a flood insurance policy, the short answer is anyone who wants full coverage for their property. Speaking with homeowners and agents across the county, we've found that many people aren't sure where their home insurance policy stops and flood insurance protection begins – until after a loss. With Orion180, homeowners can close that gap before the water rises.

Here’s a breakdown that can help you decide how to balance your risk:

- 40% of National Flood Insurance Program (NFIP) flood insurance claims come from areas outside high-risk zones.

- 1 inch of standing water can cause up to $25,000 in damage.

- Home insurance policies treat water damage (primarily caused from water sources within the home) differently than flood damage (caused by rising water outside the home).

- If your home is damaged by flood waters, you are not covered unless you have a flood insurance policy. Flood waters could be anything from a rising river or lake, to rain runoff or storm surges.

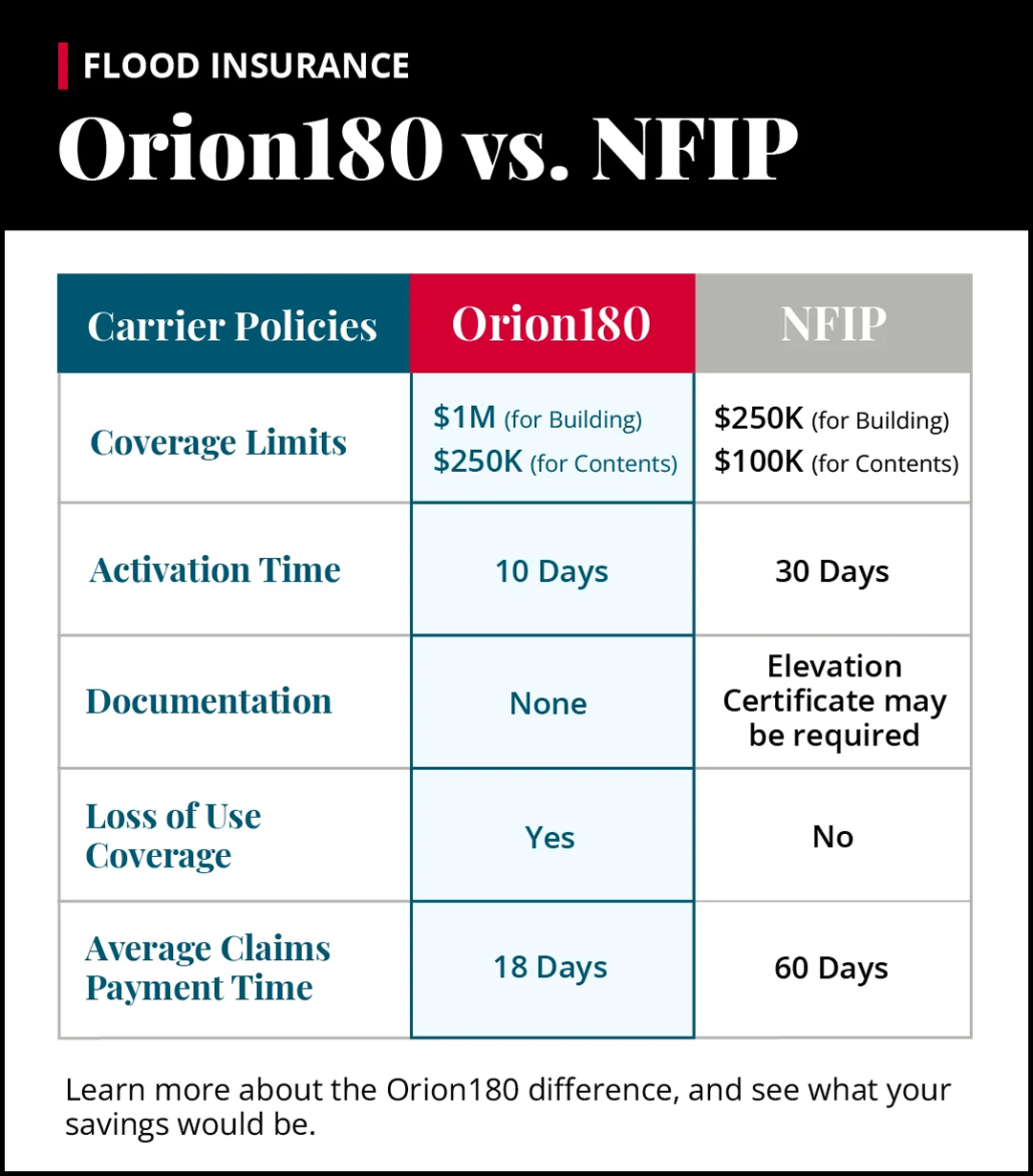

- Orion180 policies use precision pricing and can offer significant savings based on your home’s actual location and features. You’ll also get more coverage and more choice, compared to NFIP policies.

The Bottom Line

No matter where you’re located, flooding presents a significant risk to homeowners. It doesn’t always look like a disaster movie – flooding often looks like a normal storm that overwhelmed the wrong street, drain, or yard.

Flood damage is costly, and you do not have any protection without a flood insurance policy. Offering precision analysis and flexible terms, Orion180 can help you fill this gap with premiums based on your actual risk. See a breakdown of how Orion180 differs from NFIP policies below, and get a free quote today!