by: Erik J Martin, May 8, 2022

insurance.com

Home insurance is one of the most important considerations for new homeowners. It’s wise to know what your coverage includes and how it can protect you from financial losses should anything go wrong with your home, such as a fire or water damage. As a Floridian, you know that hurricanes are an important weather consideration, too.

There are a lot of insurance companies, and narrowing down the options can seem overwhelming, so we did it for you. Some of the best home insurance companies in Florida are State Farm, Travelers, Nationwide and Safeco. Read on to find out why and which company may be best for you.

KEY TAKEAWAYS

- Florida’s average home insurance rate is $3,643 which is $1,338 more than the national average of $2,305.

- Your home’s square footage, building costs in your area, and local crime rates are some of the factors that influence home insurance rates.

- You can lower your bill if you purchase more than one type of insurance policy from your insurer, this process is known as ‘bundling’ can cut your costs by 15%.

Best homeowners insurance companies in Florida

- State Farm: Best for customer service and home-auto bundle

- Travelers: Best for price

- Safeco: Best for claims

- Nationwide: Best for online transactions

Below you’ll see details on the best home insurance companies in Florida, based on Insurance.com’s customer satisfaction survey of policyholders and staff experts’ picks for various homeowner profiles.

Best for customer service and home-auto bundle: State Farm

While State Farm’s average home insurance rate ($4,237) for Florida is higher than other major carriers, it got high scores for customer service. State Farm received four (of five) stars for customer service among homeowners in the South. It also had the highest home-auto bundle discount (30%) for Florida homeowners, among those surveyed.

In addition to standard home coverage, State Farm offers:

- Increased replacement cost coverage feature that automatically boosts your replacement cost coverage up to 20% as long as you’ve insured your home at least up to its estimated replacement cost.

- Another add-on you can buy will help pay the extra cost to replace broken heating or cooling systems with energy-efficient ones.

- A benefit that pays to replace large appliances.

- Coverage to help for expenses if you need to move or repair your home due to building laws.

- It also sells earthquake insurance.

Best for price: Travelers

Travelers had the cheapest Florida home insurance rate, $1,762, which is more than half the state average of $3,643.

- Green home coverage, which pays for green materials when rebuilding or repairing your home.

- Identity fraud expense reimbursement coverage pays up to $25,000 for costs incurred to restore your identity.

- Policy management from an Alexa.

- Flood insurance.

Best for claims: Safeco

Safeco 4.5 out of five stars for claims handling in the Best Home Insurance Companies 2021 rankings for the South. In addition to standard coverage and discounts, it offers:

- Equipment breakdown coverage for $2 a month, which repairs or replaces household appliances after mechanical or electrical breakdowns.

- A single-loss deductible. If you have a car insurance policy and it’s damaged in the same event as your home, your auto deductible will be waived.

- Extended dwelling coverage after a catastrophe. When there’s soaring demand for building materials and labor that could cause reconstruction costs to increase, leaving policy limits inadequate, extended dwelling coverage kicks in.

- Identity theft recovery.

Best for online claims and quoting: Nationwide

In a digital world, you’d think all major carriers would allow you to get quotes, file and manage claims and pay your bills online, but that’s not the case with every insurance company. Nationwide, however, excels at offering online services. It is also among the best for home-auto bundle savings, with an average 12% price break.

In addition to standard coverages, it offers:

- Better Roof Replacement add-on that will replace your roof with a higher quality one than you had before.

- Replacement cost plus coverage that pays up to an additional 20% more than your policy limit if it costs more to rebuild your house.

- Ordinance or law insurance coverage that helps pay to rebuild your home to current building codes after a covered loss.

- On Your Side Review, a free personalized insurance evaluation that helps you determine what coverage is best as life events change your coverage needs.

- Credit card and debit card fraud protection.

- Earthquake and flood insurance.

Discounts beyond the standard:

- Home renovations, including electrical or plumbing upgrades.

- Gated community discount.

- Roof’s age and surface type discounts.

Top homeowners insurance companies in Florida

| Company | Best for | Florida market share | J.D. Power rating | NAIC complaints | AM Best financial strength rating | Online quote tool |

|---|---|---|---|---|---|---|

| State Farm | Customer service and bundling | 6.04 | 829 | 0.87 | A++ | Yes |

| Travelers | Price | 0.18 | 803 | 0.35 | A++ | Yes |

| Safeco | Claims | .62* | 802 | 0.44 | A | Yes |

| Nationwide | Online transactions | 0.86 | 808 | 0.33 | A+ | Yes |

* Safeco is a division of Liberty Mutual. The market share listed is for Liberty Mutual which includes Safeco.

What is the average cost for homeowners insurance in Florida?

The average home insurance cost in Florida is $3,643 which is nearly $1,338 more than the national average of $2,305 for:

- $300,000 dwelling coverage

- $1,000 deductible

- $300,000 liability

Florida is tied with Arkansas as the third most expensive state for home insurance. Oklahoma and Kansas are the top two, respectively.

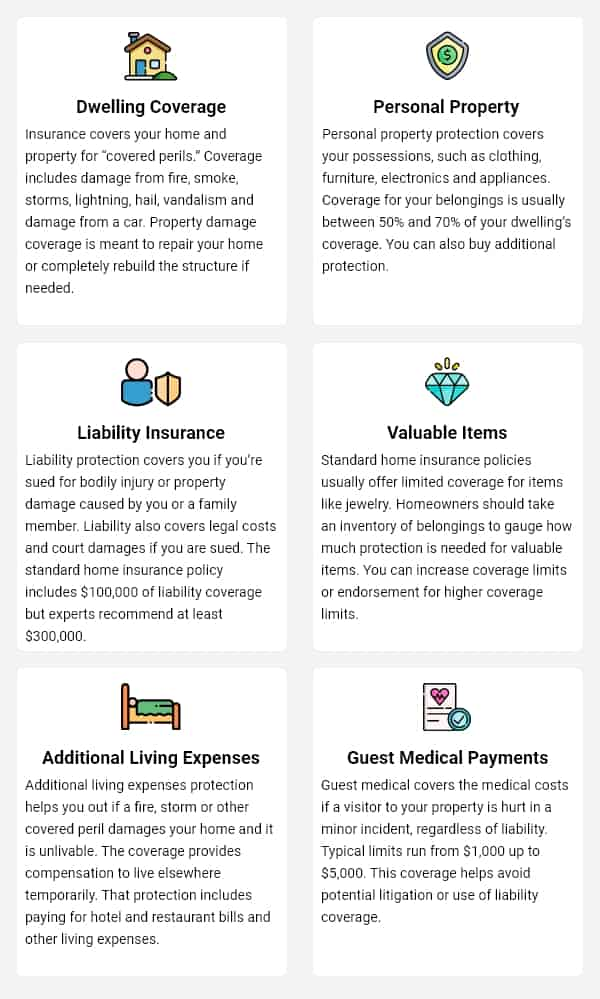

Before we dive into the other research on costs and companies, you need to know what you’re buying and why, and how much you need. So, let’s look at the basic components of home insurance, and how much to get to make sure you’re not underinsured.

Florida homeowners insurance rates by ZIP code

ZIP codes in the Florida Keys and Miami are among the most expensive places to insure a home in Florida. Tallahassee has the least expensive neighborhoods for home insurance costs. Insurance.com analyzed home insurance rates from major insurance companies in nearly every ZIP code in Florida.

For $300,000 dwelling coverage with a $1,000 deductible and $300,000 liability limits, the average rate of $5,187 in Miami ZIP code 33135 is the highest for the city. Among the most expensive ZIP codes for home insurance in the state is 33070, $6,295 for Islamorada Village of Islands. All of Tallahassee’s ZIP codes came in with rates around $2,000, and are the cheapest Florida home insurance rates by ZIP code.

By entering your ZIP code in the search box in our tool below, you’ll see the average home insurance rate for that area, as well as the highest and lowest premium fielded from major insurers. Default rates are for coverage of $300,000 dwelling, $1,000 deductible and $300,000 liability.

This will give you an idea of how much you can save by comparing home insurance rates, whether you have a modest home inland or a high-end house near the beach. For example, the highest rate ($6,407) for Gainesville ZIP 32606 is $1,466 more than the lowest ($1,034). That means you can save nearly $5,375 just by comparing rates and shopping around.

Most & least expensive zip codes for homeowners insurance in Florida

Most Expensive

| Zip Code | City | Highest Rate |

|---|---|---|

| 33040 | Big Coppitt Key | $5,576 |

| 33070 | Islamorada Village of Islands | $5,504 |

| 33001 | Long Key | $5,474 |

| 33036 | Islamorada Village of Islands | $5,437 |

Least Expensive

| Zip Code | City | Lowest Rate |

|---|---|---|

| 32307 | Tallahassee | $1,593 |

| 32306 | Tallahassee | $1,593 |

| 32313 | Tallahassee | $1,593 |

| 32304 | Tallahassee | $1,600 |

Florida homeowners insurance rates for 10 coverage levels

Here we show the average cost of Florida homeowners insurance for 10 coverage levels, based on a rate analysis by Insurance.com.

| Coverage Level | Average Rate |

|---|---|

| $200,000 with $100,000 Liability | $2,872 |

| $200,000 with $300,000 Liability | $2,876 |

| $300,000 with $100,000 Liability | $3,418 |

| $300,000 with $300,000 Liability | $3,643 |

| $400,000 with $100,000 Liability | $3,941 |

| $400,000 with $300,000 Liability | $3,962 |

| $500,000 with $100,000 Liability | $4,261 |

| $500,000 with $300,000 Liability | $4,287 |

| $600,000 with $100,000 Liability | $4,562 |

| $600,000 with $300,000 Liability | $4,576 |

Florida home insurance rates by deductible and liability limit

The cheapest Florida home insurance rates are those with the highest deductible amount and lowest liability limit. For dwelling coverage of $200,000, the premium with the highest deductible of $2,500, with the lowest liability limit of $100,000 being $3,164. That’s $674 less than the same policy with a $500 deductible.

| $200,000 dwelling/$100,000 Liability | Rate |

|---|---|

| $2,500 Deductible | $3,164 |

| $2,000 Deductible | $3,246 |

| $1,500 Deductible | $3,515 |

| $1,000 Deductible | $3,575 |

| $500 Deductible | $3,838 |

Homeowners insurance in Florida by city

Tallahassee has the cheapest homeowners insurance, among the state’s largest cities, with an average rate of $2,215 per year, which is $185 per month.

| City | Average annual rate | Average monthly rate |

|---|---|---|

| Tallahassee | $2,215 | $185 |

| Gainesville | $2,518 | $210 |

| Jacksonville | $2,799 | $233 |

| Orlando | $3,425 | $285 |

| Port St. Lucie | $3,639 | $303 |

| Tampa | $3,915 | $326 |

| Miami | $4,083 | $340 |

| Hialeah | $4,543 | $379 |

| Fort Lauderdale | $5,070 | $423 |

What factors affect homeowners insurance rates in Florida?

Because costs are not uniform, it’s crucial to shop around for the best home insurance rate.

Many factors influence home insurance prices. Among others, the Insurance Information Institute (III) cites the following:

- Your home’s square footage

- Building costs in your area

- Local crime rates

- The likelihood of certain types of disasters, such as hurricanes

You should shop around for the right policy. III suggests getting at least three quotes to save hundreds of dollars annually.

Although Florida home insurance costs can be expensive, you should still get adequate coverage. The III recommends that you get enough insurance to cover the costs to:

- Repair or replace the structure of your home and personal possessions

- Defend yourself against liability costs if someone is hurt on your property

- Pay for a temporary place to live while your home is repaired or replaced

Who has the cheapest homeowners insurance in Florida?

Travelers, First Florida, Nationwide and Castle Key are the cheapest home insurance companies among those surveyed by Insurance.com. The average rate for the same amount of coverage varies significantly, which is why it pays to compare home insurance quotes.

Homeowners insurance rates for Florida by company

| $300,000 dwelling/$1,000 deductible/ $300,000 Liability | Rate |

|---|---|

| Travelers | $1,762 |

| First Florida | $2,907 |

| Nationwide | $3,587 |

| Castle Key | $3,921 |

| Heritage | $3,978 |

| Universal | $4,168 |

| State Farm | $4,237 |

| Citizens | $4,607 |

How much do Florida homeowners insurance rates increase after a claim?

This depends on many factors.

“The variables can vary from the type of coverage you have to your deductible level to the type of loss – whether it’s a fire, water-related, or act-of-God loss,” explains Kenneth Gregg, CEO for Orion180 in Melbourne, Florida.

According to Carolyn Rummel, president of Meadowbrook Insurance Agency’s Sarasota office, homeowners policies work a little differently than auto policies because there aren’t always surcharges for claims as there would be if you were involved in an automobile accident.

Mark Friedlander, director of Corporate Communications for the Insurance Information Institute (III), notes that, while his organization doesn’t track how claims impact the percentage of policy renewals, “it’s very common for a Florida homeowner to have their policy non-renewed if they have filed more than one property claim during the last five years.”

Florida home insurance discounts

There are several ways to reduce your Florida home insurance costs, which will qualify you for home insurance discounts. Many insurers will lower your bill if you purchase more than one type of insurance policy from them – a process known as “bundling.” According to Friedlander, this can reduce your premium by more than 20%.

You can also cut your costs by making your home more disaster-resistant. Installing hurricane glass or accordion shutters might net you a discount.

“Consider adding additional safety features to your home, such as window shutters and roof attachments that can reduce windstorm portion premiums,” says Anthony Martin, CEO of Choice Mutual.

According to III, other possible home insurance discounts include:

- Installing smart devices, such as a smart thermostat or window and door sensors – 5% to 20%

- Installing smoke detectors, a burglar alarm or dead-bolt locks — 5% to 10% each

- Installing a sprinkler system, and a fire and burglar alarm — 15% to 20% each

- Loyalty discounts — up to 5% after three to five years, and 10% for six years or more

How to save on a homeowners insurance policy in Florida

Another smart way to cut your insurance costs is to raise your deductible.

“For a Florida homeowner, that means increasing your standard deductible as well as your windstorm deductible for named tropical cyclones. The hurricane deductible typically ranges from 2% to 5% of your dwelling limit,” continues Friedlander. “But while you can significantly lower your premium with higher deductibles, you need to make sure you are financially prepared to pay much more out-of-pocket for a covered loss. That could equate to several more thousand dollars for a hurricane wind loss.”

Martin also recommends consumer due diligence.

“Shop around among several different carriers. While many companies have gone bankrupt or are refusing to write new policies in Florida, there are still companies making sure Florida homeowners are protected,” he says.

Why homeowners insurance rates are going up in Florida

Make no mistake – homeowners insurance rates continue to increase in Florida. Case in point: Insurance regulators are considering raising rates for Citizens Property Insurance Corp. – the state-operated carrier of last resort – by nearly 11%, which would take effect in August 2022 if approved, according to Miami Herald reporting.

Insurance companies cite the following reasons why homeowners insurance is so expensive in Florida:

- High rates for reinsurance, which is insurance that backs up insurance companies

- Water-leak damage claims from non-hurricane causes

- Claims from recent hurricanes are still being filed, as homeowners have a three-year window to do so.

“Two other primary factors are driving the excessive rate increases Florida homeowners are experiencing: rapid roof replacement fraud schemes and runaway litigation,” says Friedlander.

“Unscrupulous roofers tell homeowners there was recent storm damage in the area and are replacing roofs for free, even when they don’t qualify for insurance coverage. The insurer rejects the claim because it’s not a legitimate insured loss [and] the contractor partners with an unscrupulous attorney to file a lawsuit against the insurer. Even if the case never goes to court, the related expenses are exorbitant for the insurer.”

Friedlander explains that Florida is the most volatile private insurance marketplace in the country and is on a trajectory toward collapse due to these roof replacement fraud schemes and runaway litigation.

“Many Florida home insurers are in a dire financial position because of these schemes,” he says. “Over the past two years, Florida insurers have posted cumulative underwriting losses of more than $3.4 billion. Furthermore, in 2021, residential insurers posted a cumulative net income loss of nearly $1 billion – more than the net income losses incurred in the previous two years combined.”

“More than 100,000 property claim lawsuits were filed against Florida home insurers in 2021, equating to more than 80% of property claim lawsuits filed in the United States. In fact, no other state has more than 900 property claim lawsuits filed last year,” says Friedlander.

Why is my Florida homeowners insurance being canceled?

The Miami Herald reported last year that several carriers were canceling tens of thousands of Florida homeowners policies, citing deteriorating financial conditions. This was partly due to increased claims from hurricanes but also from fraud, the report said.

“Florida statute Chapter 224 Part III allows insurers to cancel policies when the company would be placed in a hazardous financial situation due to an uptick in claims after hurricane damage or attorney’s fees to defend itself over fraudulent adjuster claims,” the news report said.

To prevent insurance fraud, which increases insurers’ costs, which are then passed on to consumers, state legislators passed an anti-fraud bill last year. It limits legal fees and the period in which a property-damage lawsuit can be filed.

There are many other reasons why homeowners insurance policies get canceled. Cancellation may be triggered by filing multiple claims, failing a house inspection or because your insurer believes the area you live in is too much of a risk for storm damage. Our guide on what to do if your homeowner insurance is canceled provides more details on steps to take.

How to get a homeowners insurance estimate in Florida

Home insurance quotes in Florida are not difficult to obtain.

To get a home insurance quote in Florida, begin by reviewing our top-rated Florida insurers and our annual Best home insurance companies. Once you’ve narrowed down the list to three to five companies, begin requesting the estimates.

Most insurers offer various quoting options, including online forms, via email, by phone and sometimes even in person if the agent is local.

When requesting quotes, be sure to request the same exact coverage from each insurance company. This will allow you to later compare equivalent quotes to determine where to get the best home insurance rates in Florida and best overall value.

Florida homes underwater by county

When a home is underwater, the homeowner owes more on the mortgage than the home is worth in the current market. For example, if the principal balance on your mortgage is $250,000 but the home’s fair market value is $200,000, your home is underwater. In other words, you could not sell the home and make enough from the sale to pay off your mortgage.

According to Insurance.com’s 2020 analysis of second-quarter data in Florida, Gulf, Jackson and Gadsden counties have the highest percentage of underwater homes in the state. Sumter, Clay and Pinellas have the lowest percentage of underwater homes.

| County | % Underwater | % with Equity |

|---|---|---|

| Gulf | 18.5% | 20.5% |

| Jackson | 15.5% | 21.4% |

| Gadsden | 13.2% | 17.7% |

| Putnam | 12.1% | 26.4% |

| Suwannee | 11.2% | 22.5% |

| Levy | 10.7% | 27.7% |

| Hendry | 10.0% | 31.8% |

| Bay | 9.5% | 21.8% |

| Highlands | 9.2% | 26.3% |

| De Soto | 8.1% | 32.6% |

| Baker | 8.0% | 20.9% |

| Marion | 7.9% | 23.3% |

| Wakulla | 7.9% | 15.6% |

| Okeechobee | 7.8% | 27.8% |

| Columbia | 7.6% | 22.8% |

| Leon | 7.2% | 18.4% |

| Walton | 6.9% | 26.3% |

| Alachua | 6.8% | 20.9% |

| Citrus | 6.3% | 26.7% |

| Escambia | 5.9% | 22.4% |

| Duval | 5.9% | 21.5% |

| Flagler | 5.6% | 24.9% |

| Polk | 5.6% | 22.5% |

| Lake | 5.5% | 23.3% |

| Charlotte | 5.5% | 29.1% |

| Collier | 5.5% | 29.0% |

| Indian River | 5.3% | 30.4% |

| Lee | 5.2% | 25.6% |

| Volusia | 5.1% | 27.9% |

| Monroe | 5.1% | 37.4% |

| Manatee | 5.1% | 24.5% |

| Saint Lucie | 5.0% | 27.5% |

| Hernando | 5.0% | 26.7% |

| Palm Beach | 4.8% | 29.9% |

| Sarasota | 4.7% | 28.8% |

| Broward | 4.6% | 28.2% |

| Pasco | 4.6% | 22.0% |

| Saint Johns | 4.5% | 20.0% |

| Okaloosa | 4.4% | 23.2% |

| Miami-Dade | 4.3% | 34.3% |

| Martin | 4.3% | 31.7% |

| Santa Rosa | 4.3% | 19.3% |

| Brevard | 4.2% | 30.2% |

| Hillsborough | 4.1% | 24.1% |

| Orange | 4.0% | 24.9% |

| Osceola | 3.9% | 21.8% |

| Nassau | 3.9% | 26.1% |

| Seminole | 3.8% | 25.6% |

| Sumter | 3.8% | 32.6% |

| Clay | 3.7% | 19.2% |

| Pinellas | 3.1% | 33.8% |

What happens if your insurance company goes out of business

Rest assured that, when an insurer is declared insolvent in Florida, the policyholder is protected by the Florida Insurance Guaranty Association (FIGA), with all outstanding claims paid by FIGA.

“However, you may need to seek new coverage quickly, and you will be provided only 30 days’ written notice of cancellation, per state regulations,” cautions Friedlander.

If you learn that your carrier is going out of business or not writing policies in your state anymore, “the first thing you should do is contact your insurance agent. This will be your primary point of contact to formulate a game plan,” recommends Gregg.

How consumers can protect themselves financially while also protecting their homes

The best way to safeguard your property and your financial interests is, first, to choose the right insurer.

“Make sure you are covered by an ‘A’-rated carrier, as determined by its financial ratings assigned by AM Best or Demotech,” Friedlander says.

Additionally, ensure that you have the right amount and type of coverage in place before hurricane season approaches.

“Conduct an insurance review with your insurance agent to identify any gaps in coverage. Make sure you have the right amount of dwelling coverage, too, as home replacement costs have increased more than 16% year-over-year – double the US inflation rate – due to escalating costs of construction materials and labor,” says Friedlander.

Also, work to keep your property well-maintained and preserve your credit.

“Those tend to be two key items in securing a financial win for the policyholder,” says Gregg.

Florida home insurance FAQ

What is wind mitigation?

Another way to save money on insurance is to fortify your home against wind damage. Making additions and renovations to your home can make it more resistant to hurricane damage. For example, you might seal the roof deck to keep stormwater out. Or, you might install shatterproof glass.

By law, Florida insurers must offer mitigation discounts or credits to homeowners who take steps to make their homes less vulnerable to hurricane damage. The Florida Office of Insurance Regulation offers more information on its website.

Why do I need flood insurance?

If you have Florida home insurance, don’t assume you are covered in the event of a flood. A homeowners policy does not cover flood damage — the most common natural disaster in the U.S., according to III.

The Federal Emergency Management Agency (FEMA) offers flood insurance to homeowners through the National Flood Insurance Program (NFIP).

In terms of flooding, Florida is at especially high risk for storm surges. In fact, Florida ranks first in terms of the most single-family homes at risk of storm surge in a Category 5 hurricane (2,851,642) and the highest dollar amount for how much it would cost to repair and reconstruct those homes ($580.6 billion).

Nationally, according to III, the average NFIP premium was $958 in 2021.

Why do I need hurricane windstorm insurance?

Florida is at significant risk for hurricanes every year, and the damage can be costly. Five of the 10 most costly U.S. hurricanes based on insured losses have impacted the Sunshine State, according to the III.

And there is nowhere to hide if you are a Florida homeowner. More than 75% of the state’s population lives in a coastal county, putting these residents in danger of a hurricane’s high winds and storm surge. Even inland areas, such as Metro Orlando, can sustain significant wind and flood damage from a tropical system.

How do hurricane deductibles work?

An increasing number of insurance companies are turning to percentage deductibles when insuring homes. This is especially true for windstorm coverage.

A percentage deductible can be considerably more expensive than a traditional deductible. Instead of paying a flat fee of $500 (state minimum deductible), you could be charged a percentage of your overall Florida home insurance dwelling coverage amount. A 2% deductible on coverage of $100,000 leaves you on the hook for $2,000.

Insurance companies in Florida must offer a hurricane deductible of either $500, 2%, 5% and 10% of the policy dwelling or structure limits, The III says. All percentages are based on the policy’s dwelling limit. The good news in Florida is that windstorm deductibles apply per season, not per storm. So if you have the misfortune to be hit by three storms in one year, just one hurricane deductible is applied during the same calendar year.

What do I do if I can’t get homeowners insurance in Florida?

Some people struggle to find coverage. The Florida Market Assistance Plan allows these homeowners to locate and purchase coverage from authorized insurers in the private market. The toll-free telephone number is 1-800-524-9023.

Citizens Property Insurance Corp. the state’s property insurer of last resort, is another option for homeowners who can’t find good Florida home insurance coverage. For example, many Floridians use Citizens for windstorm coverage if they live in wind-pool areas near the coast, making their private homeowners insurance company unlikely to provide windstorm protection.

Florida law states that Citizens can only issue a new insurance policy only if no comparable private market coverage is available, or comparable private market policy premiums are more than 15% higher than a similar Citizens policy.

Are sinkholes covered?

Florida has more sinkholes than any other U.S. state. Sinkhole coverage might or might not be part of your standard homeowners policy coverage.

According to the Florida Department of Financial Services, state law dictates that all insurance companies licensed in Florida must offer sinkhole coverage. In most cases, this coverage is available as an endorsement to your standard policy and will cost an additional premium.

However, insurers have the right to inspect your property and — if evidence of sinkhole activity is found — to decide not to offer you the coverage. They can also refuse coverage if your home is within a certain distance from confirmed sinkhole activity. If you are embroiled in a sinkhole claim dispute with your insurer, the Florida Department of Financial Services Neutral Evaluation program offers a neutral third-party professional to review the insurer’s findings. It is important to note that the DFS assessment is not binding to the policyholder or the insurer.

Is mold covered?

Mold that results from a covered peril — such as a burst pipe — typically is covered under a Florida home insurance policy. However, mold remediation coverageis often capped at around $10,000. It might be possible to increase such limits by paying an additional premium amount. It’s important to note that some policies do not cover mold damage at all, depending upon the insurer.

What is an ordinance or law exclusion?

In some cases, law or local building ordinance can make it more expensive to repair or replace your home. If this happens, your insurer typically is not obligated to pay this higher amount. However, some policies include ordinance or law coverage. In that case, the insurer would be obligated to pay the extra amount due to changes in local building codes.

Where do I get claims processing info or file a complaint?

If you have concerns about how your property claim was handled, call the Florida Department of Financial Services at 1-877-MY-FL-CFO (1-877-693-5236). The department recommends keeping records of all dates and times and names of company representatives when you communicate with your insurer about a claim. Keep copies of written documents and correspondence as well.

You can also file your complaint online with the state’s Division of Consumer Services if you prefer.

If you cannot resolve a claim dispute with your insurer, mediation might be available. In this process, a trained, neutral mediator works with both parties and tries to reach a mutually satisfying agreement. The insurer is required to pay for the service, and neither the insurer nor you are obligated to accept the result. To find out if you are eligible, call 1-877-MY-FL-CFO (1-877-693-5236).

The mediator’s findings are not legally binding to the policyholder or the insurer.

Methodology:

Insurance.com in 2020 commissioned Quadrant Information Systems to field home insurance rates from major insurers in each state for nearly all ZIP codes in the country for 10 coverage levels based on various dwelling and deductible limits. The homeowner profile is a 35-year-old married applicant with excellent insurance score; new business HO3 policy for house built in 2000 with frame construction and composition roof. Other Structures: 10%. Loss of Use defaulted: 10%. Personal Property defaulted: 50%. Guest Medical limit: $5,000. Personal property: 50% of dwelling coverage for actual cash value.

Homeowners insurance rates in Florida by city

| Fernandina Beach $2,513/year | Fort Lauderdale $8,997/year | Gainesville $1,820/year | Hialeah $9,635/year |

| Palm City $7,955/year | Port St. Lucie $6,874/year | Tallahassee $1,613/year | Wauchula $3,040/year |